GENERAL INFORMATION

The British Virgin Islands (“BVI”) are a group of 40 islands and islets located in the Caribbean 60 sea miles east of the Island of Puerto Rico and easily accessible by airplane. The area is 153 square kilometers with the best-known islands of Tortola, Virgin Gorda, Anegada and Jost Van Dyke. Tortola, or “land of turtle doves” is the largest of the BVI with the capital of Road Town and a topography of largely rolling hills and beaches, rising to 1,780 feet at Mount Sage the highest point. The resident population is approximately 21,000 of which the majority lives in Tortola and enjoys a tropical climate.

The business environment of the BVI is favorable with excellent communication systems worldwide, nearly 100% literacy rate and English as the main language. The principal component of the Gross National Product (“GNP”) is tourism, with the international service industry coming in second.

The BVI is a British Crown Colony with its corporate law based on the English common law and had an excellent reputation of political stability. The Islands are self governing, with a Governor who chairs the Executive Council. There is also Legislative Council and a judicial system that is under the direction of the Eastern Caribbean Supreme Court with final appeal to the Privy Council in London, England.

HIGHLIGHTS OF BVI BC COMPANIES

The BVI Business Companies Act, 2004 (“BC Act”) came into effect on January 1st, 2006, to replace the International Business Companies Act, 1984 and the Companies Act (Cap 285).

The BVI BC Act is being phased in over a two-year transition period as follows:

2005 –Until December 31st, 2005, companies could be formed under the old IBC Act.

2006 –Beginning January 1st, 2006 all new incorporations will be formed ONLY under the BVI BC Act.

During the period January 1st, 2006 through December 31st, 2006, existing companies incorporated under the original IBC Act or the domestic “Companies Act” will be permitted to continue operating under those Acts to enable them to prepare for transition to the new Act.

2007- On January 1st, 2007, companies maintained under the existing IBC Act and Companies Act will automatically be re-registered under the BVI BC Act. By 2007, all companies registered in the BVI will be operating under the new regime.

CORPORATE REQUIREMENTS

Name:BC names must contain the words Corporation, Incorporated, SociedadAnónima, SocietéAnonyme, Limited, or their abbreviations. Chinese names together with their English translation can be registered in the BVI. Numbers are permitted as part of the company name together with foreign characters.

The name must not include words such as bank, insurance, assurance, reinsurance, trust, trustee, cooperative, royal, imperial, municipal, chartered, building, society, chamber of commerce, securities, fund, or their derivatives, except with the written approval of the Registrar and the obtainment of a license, where required. A company name can be verified by direct computer link with the Registry and confirmed within one hour of being requested. The incorporation will usually take two to three working days.

Incorporator:All companies must apply to the Registry for incorporation by filing a memorandum and articles of association signed by the proposed registered agent, as incorporator.

Number and Classes of Shares:The “authorized capital” and “share capital” concept, as we know it, no longer exist under the BVI BC Act. The BVI BC Act specifies the requirement for the memorandum to state the maximum number of shares that the company is authorize to issue. BVI BC’s are not required to specify the par value of its shares or the currency, however, clients may request this option.

All companies must state the classes of shares it is authorized to issue, and, if the company is authorized to issue two or more classes of shares, the rights, privileges, restrictions and conditions attaching to each share.

Registered Office / Agent:EveryBC must have a Registered Office and a qualified Registered Agent in the BVI. OVERSEAS MANAGEMENT COMPANY TRUST (BVI) LTD. is a qualified Registered Agent.

Shareholders: A minimum of one shareholder is required. Corporate or natural shareholders are permitted. No details of the shareholders appear on the public file but a register of shareholder must be kept at the registered office address of the BVI Company.

Directors / Officers:The first register agent must appoint a director within 6 months of the date of incorporation of the company. A person shall not be appointed as Director unless he or she has consented in writing to be a director.A company shall have one or more directors and the number of directors may be fixed by the articles of the company.

Where a company has a sole member acting as the sole director, that person can appoint a Reserve Director who will become the director of the company upon the death of the sole director. The Reserve Director must consent in writing to act as director.

Register of Members:As specified in the BVI BC Act, all companies MUST AND SHALL keep a register of members. The Register by itself or a copy must be kept at the registered office, and as prescribed by law and in our M&AA's, the registers may be written or magnetic/electronic form, as long as legible evidence can be produced.

The registers of members must contain the following information:

- Names and addresses of the shareholders (registered shares)

- Number of each class and series of registered shares held by a shareholder

- Number of each class and series of bearer shares held by a shareholder

- Information with respect to bearer share certificates, including the name and address of custodian

- Date when name of each member was entered in the register

- Date when any person ceases to be a member

Company Records: The Registered Agent must maintain the following documents at its office: the company’s M&A, the Registers of Directors and Members or copies of the same and minutes of meetings and resolutions of members and directors, unless the directors resolve otherwise whereby they must advise the registered agent where they are being kept within 14 days.

If the Registered Agent is only in possession of copies of the registers, the company is obligated to advise the agent of any changes to these registers within 15 days of those changes being made. The Registered Agent must also be advised in writing of the location of the original registers.

Continuation:The BVI BC Act establishes that a company that desires to continue under the jurisdiction of the BVI will have to file satisfactory evidence that the law of the foreign country permit the migration of the company.

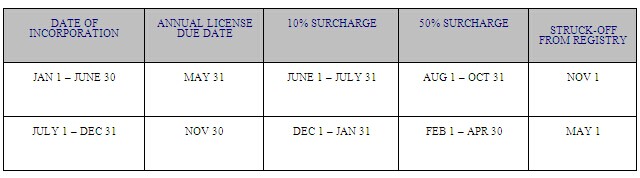

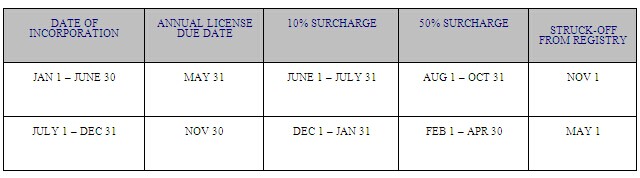

ANNUAL LICENSE DUE DATE AND PENALTIES AFTER THE FIRST YEAR OF INCORPORATION